In today’s fast-paced business environment, maintaining financial health is more crucial than ever. As businesses navigate economic fluctuations, regulatory changes, and evolving consumer demands, proactive financial management becomes key to sustained growth and stability. Here, we present a comprehensive financial health checklist designed to help you evaluate and strengthen your business’s financial foundation.

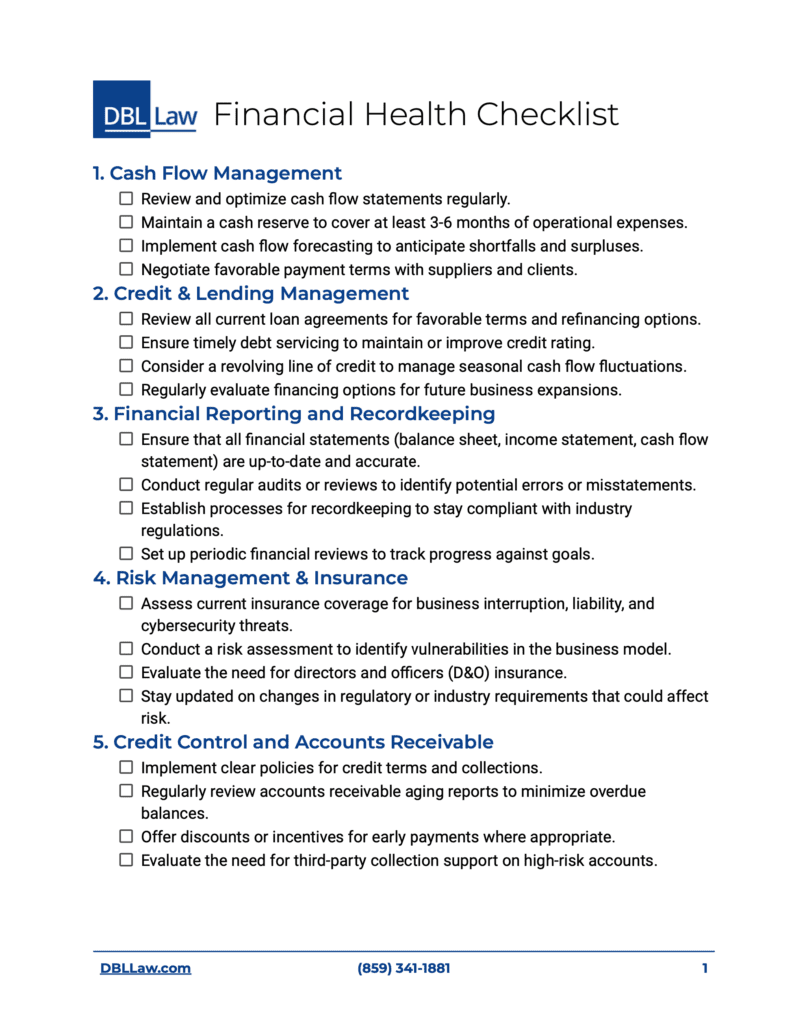

1. Cash Flow Management

Cash flow is the lifeblood of any business. Effective cash flow management ensures your company has enough liquidity to cover operating expenses, seize growth opportunities, and navigate financial challenges.

- Review and optimize cash flow statements regularly to track where cash is coming from and where it’s going.

- Maintain a cash reserve that covers 3-6 months of operational expenses, allowing your business to manage fluctuations and unexpected expenses.

- Implement cash flow forecasting to anticipate periods of surplus and shortfall. This insight can guide decisions on spending, investments, and capital needs.

- Negotiate favorable payment terms with both suppliers and clients to improve cash position and reduce payment delays.

2. Credit & Lending Management

Proper management of credit and loans is essential to financial stability and growth. Ensuring favorable terms and timely repayment can improve your credit rating and access to capital.

- Review loan agreements to determine if refinancing is an option that could lower your interest rates or improve cash flow.

- Service debts on time to maintain or enhance your credit rating, which can lead to better financing terms in the future.

- Consider a revolving line of credit to handle seasonal or unexpected expenses, providing a financial cushion when cash flow is tight.

- Explore financing options to support future expansions or large purchases.

3. Financial Reporting and Recordkeeping

Accurate and timely financial reporting enables informed decision-making and ensures compliance with legal and tax obligations.

- Maintain up-to-date financial statements (balance sheet, income statement, cash flow statement) to provide an accurate picture of your financial health.

- Conduct regular audits or reviews to identify errors, omissions, or financial misstatements that could impact decision-making or compliance.

- Establish efficient record keeping processes to meet regulatory and tax requirements and make audits easier.

- Schedule periodic financial reviews to measure progress toward financial goals, adjust strategies, and make improvements.

4. Risk Management & Insurance

Every business faces risks, from data breaches to natural disasters. Managing these risks through appropriate insurance and proactive planning is critical for business continuity.

- Review insurance policies to ensure adequate coverage for business interruption, liability, and cybersecurity incidents.

- Conduct a risk assessment to identify vulnerabilities and potential areas of liability.

- Evaluate directors and officers (D&O) insurance, which can be essential protection for business leaders.

- Stay updated on regulatory changes that could affect business operations and insurance needs.

5. Credit Control and Accounts Receivable

Good credit control is essential to avoid cash flow issues and ensure timely payments from customers.

- Set clear policies for credit terms and collections to avoid payment delays and misunderstandings.

- Monitor accounts receivable aging reports to minimize overdue balances and proactively manage collection efforts.

- Offer early payment incentives where feasible, to encourage quicker payment from clients.

- Consider third-party collection support if you face challenges with high-risk accounts.

6. Legal Compliance and Contract Review

Legal compliance is a foundation of financial health. Regular reviews of contracts and adherence to regulations can save costs, prevent disputes, and protect your business.

- Review all contracts with customers, suppliers, and vendors to ensure favorable terms and legal compliance.

- Ensure compliance with applicable federal, state, and industry regulations, which may change periodically.

- Conduct annual legal audits to identify potential compliance risks or gaps in contracts.

- Confirm contract enforceability and keep amendments properly documented.

7. Profitability Analysis and Cost Control

Monitoring profitability and managing costs are essential for sustainable growth. Analyzing profitability across products or services helps identify areas that need adjustment.

- Conduct a break-even analysis to ensure products or services cover costs and contribute to profitability.

- Identify and reduce high-cost areas by negotiating rates with suppliers, implementing efficiency measures, or eliminating non-essential expenses.

- Regularly review profit margin for each product or service to make informed pricing and operational decisions.

- Set clear profit targets and benchmark performance against industry standards.

8. Business Valuation and Succession Planning

Knowing your business’s value and planning for the future are key components of long-term financial health.

- Obtain a professional business valuation to understand current market value, which can aid in decision-making and succession planning.

- Create a succession plan to ensure smooth transitions in leadership or ownership if needed.

- Review buy-sell agreements with partners or stakeholders to prepare for potential changes in ownership.

- Update your business plan to reflect long-term goals, potential exit strategies, and succession planning.

9. Tax Compliance and Efficiency

Efficient tax planning and compliance can reduce liabilities and prevent costly fines or audits.

- Conduct regular tax assessments to identify potential tax-saving opportunities.

- Stay informed about tax law changes that may impact deductions, credits, or liabilities, and adjust strategies accordingly.

- Plan for quarterly tax payments to avoid unexpected liabilities and manage cash flow better.

- Investigate available tax incentives for activities like research and development (R&D) or environmental improvements.

10. Digital Security & Fraud Prevention

As businesses become increasingly digital, protecting financial and customer data from cyber threats is essential.

- Secure payment processing to protect customer data and meet regulatory requirements for data protection.

- Update cybersecurity protocols regularly, especially around financial transactions.

- Train employees on fraud prevention and data security practices to reduce vulnerabilities.

- Use multi-factor authentication and monitor accounts for unusual activity as preventative measures.

11. Growth Planning & Investment Readiness

Planning for growth and preparing for potential investment opportunities are essential for a business to thrive in the long run.

- Define specific growth goals and identify necessary capital or resources for expansion.

- Keep financial statements organized and up-to-date, as these are essential for attracting investors or lenders.

- Conduct due diligence for potential partnerships or acquisitions to avoid legal and financial pitfalls.

- Monitor market trends to stay competitive and identify new opportunities that align with your goals.

Regularly reviewing and maintaining these financial health areas can help you build a resilient, growth-oriented business. This checklist not only helps you manage day-to-day finances but also prepares you for strategic growth, regulatory changes, and unforeseen challenges. For more tailored support, contact DBL Law’s Banking and Commercial Practice Group—we’re here to guide you on your financial journey.

Download Your Financial Health Checklist